7000- then the bonus is calculated on the actual amount by using the formula. How to calculate your supplemental wages bonus tax rate.

Retention Bonus Definition Steps Advantages Disadvantages

Indiana Bonus Tax Percent Calculator.

Does bonus get taxed in india. Taxes will be withheld from your bonus according to the percentage method or the aggregate method. If the gross earning of your employees is below Rs. Answer 1 of 2.

Usual tax tax on bonus amount R258083 R260000 R518083. Bonus of any type such as performance linked sales target linked ratings linked and incentive schemes are fully taxable. Employers have to deduct tax asthey deduct it in the case of employees salary.

When you pay your employee a bonus this is treated by the ATO as paying wages. 21000 employers are liable to pay bonus. Read on to learn how much tax you can expect to pay on your bonusand for tips on reducing your tax liability.

With this tax method the IRS taxes your bonus at a flat-rate of 25 percent whether you receive 5000 500 or 50 however if your bonus is more than 1 million the tax rate is 396 percent. If youre in the 33 tax bracket and you receive a bonus of 100000 you will pay 33000 in federal taxes. Likewise are bonuses taxable in India.

Or your employer can add the bonus to your regular wages calculate the income tax as if the total is a single payment and then subtract the tax withheld for the regular wages. If your employer has withheld income tax from your regular wages throughout the year it can opt to apply a bonus tax rate of 22 and withhold taxes accordingly. Bonuses are considered supplemental income by the IRS and are taxed differently depending on your tax withholdings.

And although the bonus is subject to specific tax rules when its paid when Tax Day comes its treated just like any other kind of income. That means you could earn some of your bonus back in the form of a refund if your tax return shows too much was withheld for your total taxable income level after accounting for deductions and credits. Working hard all year to help your company meet its annual goals deserves a reward and youve definitely earned that bonus.

The Indiana bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding. Youll notice this method gives a lower tax amount ie. The tax on your bonus amounts to R9300 31 of R30000 and you will receive R20700 after tax.

The general rule is that you are taxed at the rate of the marginal tax bracket in which you fall. Calculation of bonus will be as follows. When an employer taxes your bonus using the percentage method it must identify the bonus as separate from your regular wages.

Employee bonuses are always taxable to employees as an employee benefit no matter how or when they are paid. Answer 1 of 13. As per the Indian tax law bonus received by anemployee from an employer will be considered as part of salary andsuch amount will be taxable in the financial year on due orreceipt basis whichever is earlier.

If Salary is more than Rs. Employee bonus payments payroll tax. If Salary is equal to or less than Rs.

This Indiana bonus tax calculator uses supplemental tax rates to calculate withholding on special wage payments such as bonuses. As per the Indian Income tax acts and rules the tax will be calculated as per the tax slab rate Tax slab rates. Because of this bonus payments are liable for payroll tax.

For example a bonus paid to an employee at the time of hire sometimes called a signing bonus is subject to all employment taxes. As per the Indian tax law bonus received by an employee from an employer will be considered as part of salary and such amount will be taxable in the financial year on due or receipt basis whichever is earlier. You may be able to offset some of the taxes with deductions.

But bonuses count toward your income for the year so theyre subject to income taxes. Calculating your actual bonus tax rate in a typical tax year isnt that hard. The withholding rate for supplemental wages is.

If you get a bonus at work you might have to pay income taxes on it. According to income tax act joining bonus will be treated as profit in lieu of salary and will be taxable in the hands of the employee who receive it. Bonuses arent taxed at 40.

Your bonus is taxed at the same rate as all of your other income. When you receive the amount your employer will deduct income tax from it and deposit it with the government of India for which you will be receiving a proof of such payment at the end of the year. Bonus Salary x 833100.

7000- then the bonus is calculated on. For instance if the employer declares an employee bonus of INR 50000 on 24th March 2019 but the bonus is actually paid on 15th April 2019 the bonus would be deemed to be received in the financial year 2018-19 and would be taxed in that year. Luckily you can take steps to minimize the tax on your bonus.

There may be a rule that they are withheld at 40 but when you received your W-2 at the end of the year all of the wages are combined and there is no difference between vacation wages bonuses overtime and regular wages. Learn how bonuses are taxed so you can plan for the year. R534083 - R518083 R160 than the annualisation method does meaning that Thandis tax being withheld is closer to.

Payroll tax amounts vary and are payable if your business exceeds the payroll tax threshold. The income that is earned or accrued in India by an individual as variable pay forms a part of the total income.

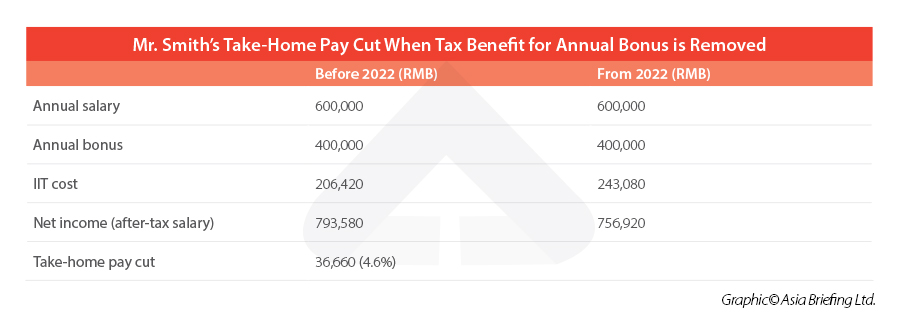

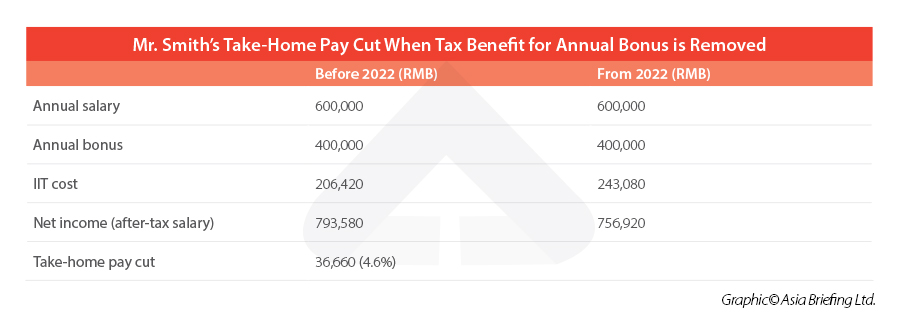

China Annual One Off Bonus What Is The Income Tax Policy Change

Top India Online Casinos For Indian Players Rupee 2020 Online Casino Casino Lottery

Whait Is Bitcoin Cryptocurrencymining Bitcoin What Is Bitcoin Mining Bitcoin Mining Hardware

Online Health Insurance Plans By Bajaj Allianz Include Individual Health Insurance Fa Health Insurance Plans Best Health Insurance Individual Health Insurance

China Annual One Off Bonus What Is The Income Tax Policy Change

Realestate Trivia Quiz Underwater Music Quiz Real Estate

13th Month Pay An Employer S Guide To Monetary Benefits

Here S Why Your Bonus Is Taxed So High Business Insider India

M A Stay Bonus As A Retention Incentive

How Does A Yearly Bonus Affect My Tax Returns Taxact

Why The Bonus Tax Rate Is Bad News For Your Tax Refund

Optimizing Employee Take Home Pay In China Through Annual Bonuses Part 2 China Briefing News

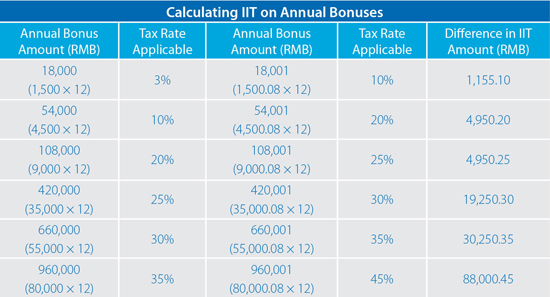

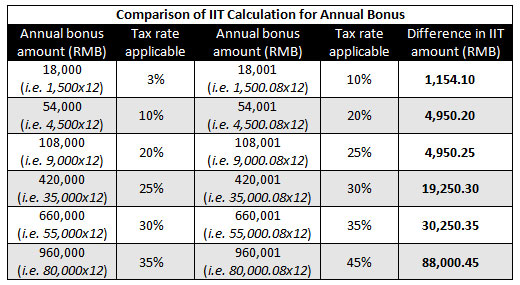

Calculating Individual Income Tax On Annual Bonus In China China Briefing News

Introducing A Cgt Pension Bonus Scheme Willis Towers Watson

Child Education Planning Education Plan Kids Education Education Funding

How Bonuses Are Taxed Credit Karma Tax

Calculating Individual Income Tax On Annual Bonus In China Updates Dezan Shira Associates

How Can We Fill Bonus Details In Itr Vakilsearch

Bonus Time How Bonuses Are Taxed And Treated By The Irs The Turbotax Blog

1 comments:

your information is very informative ! you reach us at Diamonda Gold 4cs of diamonds GOLD. Shop Now!

Post a Comment