How Your Bonus Gets Taxed. 17250000 Tax and NI Calculation with Graph.

How Bonuses Are Taxed Calculator The Turbotax Blog

As an employer providing bonus payments to your employees you have certain tax National Insurance and reporting obligations.

How much tax and ni will i pay on my bonus. Total paid on Bonus 13000. If you receive a very large bonusover 1 millionsome of it will be taxed at a higher rate. 14250000 Tax and NI Calculation with Graph.

Federal Bonus Tax Percent Calculator. Up to 20 cash back Regards it says. 16750000 Tax and NI Calculation with Graph.

A bonus from your employer is always a good thing however you may want to estimate what you will actually take-home after federal withholding taxes social security taxes and other deductions are taken out. Your bonus may also be subject to state taxes although the withholding rate will vary depending on your state. If you receive a bonus from work on top of regular salary you are liable to income tax national insurance and other deductions on the additional income.

If you are receiving the money as part of your salary then it will be taxed automatically under PAYE. Uniform tax rebate 4. The fact is that theres no special bonus tax rate.

10000 20000 30000 40000 50000 60000 70000 80000. A portion of your bonus will therefore be taxed at 26 up to the point where you are in the next tax bracket and the remainder will be taxed at 31. To give you an idea of how much tax you might pay on the bonus I would expect that you will have 20 deducted for tax and 12 deducted for National Insurance.

15250000 Tax and NI Calculation with Graph. Transfer unused allowance to your spouse. From your basic pay you earned 3570000 in the 20102011 Tax Year on which you were taxed 756800 and paid National Insurance of 329780 With your bonus of 7140 your new Annual Gross Income would be 4284000 You would owe additional tax of 285600 You would owe additional National.

Student loan pension contributions bonuses company car dividends Scottish tax and many more advanced features available in our tax calculator below. All you need to know is your gross salary and bonus amount. The withholding rate for supplemental wages is 22 percent.

16250000 Tax and NI Calculation with Graph. I will be getting my first bonus in February which I have been told is 25000. It doesnt have its own rate of tax.

With this tax method the IRS taxes your bonus at a flat-rate of 25 percent whether you receive 5000 500 or 50 however if your bonus is more than 1 million the tax rate is 396 percent. Use this service to estimate how much Income Tax and National Insurance you should pay for the current tax year 6 April 2021 to 5 April 2022. Use this calculator to help determine.

If your state does not have a special supplemental rate you will be forwarded to the aggregate bonus calculator. Up to 2000yr free per child to help with childcare costs. Marriage tax allowance 3.

This federal bonus tax calculator uses supplemental tax rates to calculate withholding on special wage payments such as bonuses. 15750000 Tax and NI Calculation with Graph. All you need to do is enter your regular salary details.

12 25000 3000. PercentageIn many cases the IRS will use the percentage method because your employer will pay your bonus separate from your regular pay. National Insurance is purely based on pay periods.

So when you are paid your bonus the NI will be based on your pay for the month. If your bonus totals more than 1. This means that after tax you will take home 542 every month or 125 per week 2500 per day and your hourly rate will be 313 if youre working 40 hoursweek.

Calculate your net salary and find out exactly how much tax and national insurance you should pay to HMRC based on your income. Net bonus in my account 12000. HMRC only give weekly figures.

If your salary is 6500 then after tax and national insurance you will be left with 6500. If my calculations are correct I will pay on my bonus. 17 of your 13800 salary gives a gross bonus of 2346 so you would pay 46920 tax and 28152 NI leaving you with 159528 plus whatever is left of your salary that month.

I cant find a monthly NI table to check your figures but I would guess that a small part of your bonus will suffer 12 NI but the rest will be at 2. How much tax and national insurance will I pay on 6500. Much like other variable incomes such as commission theres a misconception that tax on a bonus payment is withheld at a higher rate.

Your bonus amount simply becomes part of your total taxable income for the year which may impact your tax. On the other hand if it is from another source you will need to. This tells you your take-home pay if you do not have.

That rate will be applied to any supplemental wages like bonuses up to 1 million during the tax year. 14750000 Tax and NI Calculation with Graph. But assuming that you are a 40 tax payer then from 2206 you are looking at receiving around 1278 after income tax and National Insurance.

To make planning easier we have produced this quick tool to allow you to see how much of any bonus you get to keep and how much is taken off for the Treasury. Because your normal salary will have taken you over the tax free allowance it means all of your bonus is eligible for tax depends what other deductions you have but it will be around 31 for tax 20 and NI think its 11. 40 25000 10000.

Reduce tax if you wearwore a uniform. Youll have 22 federal tax withheld on the first million then 37 on bonus funds above the first million. Free tax code calculator 2.

Check your tax code - you may be owed 1000s.

How The Irs Will Treat Those One Time Tax Bonuses

All You Need To Know About The Payment Of Statutory Bonus Legawise

How Bonuses Are Taxed Calculator The Turbotax Blog

Bonus Time How Bonuses Are Taxed And Treated By The Irs The Turbotax Blog

Tax On Bonus How Much Do You Take Home Uk Tax Calculators

What Is The Bonus Tax Rate For 2021 Hourly Inc

What Are Marriage Penalties And Bonuses Tax Policy Center

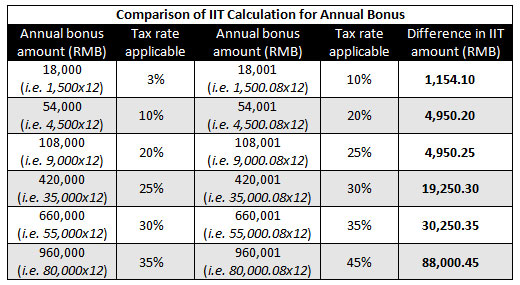

Calculating Individual Income Tax On Annual Bonus In China China Briefing News

Got A Bonus From Work What You Need To Know About The Bonus Tax Rate Marcus By Goldman Sachs

How Are Bonuses Taxed With Bonus Calculator Minafi

Taxes On Military Bonuses Military Benefits

How Bonuses Are Taxed Turbotax Tax Tips Videos

How Bonuses Are Taxed Credit Karma Tax

Christmas Bonus Vs Year End Bonus Is There A Taxable Difference E File Com

Got A Bonus At Work Tips To Minimize Tax On Your Bonus Credit Karma

China Annual One Off Bonus What Is The Income Tax Policy Change

How Bonuses Are Taxed Calculator The Turbotax Blog

Calculating Individual Income Tax On Annual Bonus In China Updates Dezan Shira Associates

0 comments:

Post a Comment